- Revenue of 2,621 million euros, up 6.5% and 2.8% on a like-for-like basis[1]

- Strong lottery fundamentals, 4.9% excluding Euromillions and Amigo

- Good momentum in sports betting and online gaming open to competition, up +10.9%, supported by a presence in all gaming segments

- Strong growth in all online games with an 18.8% increase in net gaming revenue (NGR)[2], to nearly 13% of the Group’s NGR

- Integration of Premier Lotteries Ireland and ZEturf in line with expectations

- Recurring EBITDA of €657m, up 11.3%, i.e. a margin of 25.1%

- Excluding non-replicable year-end items, the margin would be 24.3%

- Net profit of €425m, which benefited from the high level of recurring EBITDA and the very sharp change in financial profit

- Responsible growth with recognised societal commitments

- Expanded and recreational gaming model and continued commitments to reduce the share of gross gaming revenue generated by high-risk players

- Implementation of the partnership with the non-profit sector to support the prevention of underage gambling: €10m over the period 2023-2027

- Extra-financial ratings maintained at the highest level

- Performance benefiting of all stakeholders

- 3 billion euros contribution to public finances

- 56,000 jobs maintained or created in France

- 983 million euros paid to retailers

- Strong dividend[3] growth at 1.78 euro per share, i.e. a payout ratio of 80%

- 2024 targets: revenue growth in lottery and sports betting and online gaming open to competition activities in France of around 5%. With the contribution from other activities (International, Payment & Services), the Group’s revenue growth should be around 8%. Recurring EBITDA margin of around 24.5%

- On 22 January 2024, FDJ announced a tender offer for Kindred to create a European gaming champion

- The tender offer will open on 20 February 2024 for a period of nine months. In particular, its completion will remain subject to obtaining regulatory authorisations.

Boulogne-Billancourt (France), 15 February 2024 (7:00 a.m.) – La Française des Jeux (FDJ), the leading betting and gambling operator in France, announces its 2023 results and 2024 outlook.

Stéphane Pallez, Chairwoman and CEO of the FDJ Group, said: “FDJ delivered solid growth and results this year. The Group reached in 2023 a major milestone in the implementation of its strategy with the completion of the acquisition of Premier Lotteries Ireland and ZEturf. The proposed acquisition of Kindred, announced at the end of January, will enable the creation of a European champion and significant value creation for the benefit of all stakeholders, in line with our model combining performance and responsibility.”

Key figures (in millions of euros)

| 2023 | 2022 | Change in | |

| Revenue* | 2,621 | 2,461 | +6.5% |

| Recurring operating income | 532 | 459 | +15.8% |

| Net income | 425 | 308 | +38.1% |

| Dividend per share (€) | 1.78 | 1.37 | +29.9% |

| Recurring EBITDA** | 657 | 590 | +11.3% |

| Recurring EBITDA/revenue margin | 25.1% | 24.0% |

* Revenue: net gaming revenue and revenue from other activities

** Recurring EBITDA: recurring operating income adjusted for depreciation and amortisation expense

2023 highlights

Lottery, sports betting and online gaming open to competition

- Strong lottery fundamentals: revenue of €1.938m, up 1.1% and up 4.9% excluding Euromillions and Amigo

- Successful animation of the instant games portfolio, such as the launches and relaunches of Carré Or in January, Club Color in March, As de Cœur in October and Mission Nature in November.

- Successful launch of EuroDreams, in partnership with eight European lotteries

This game, whose first draw took place on 6 November, gives players the chance to win up to €20,000 a month for 30 years at tier 1 and €2,000 a month for five years at tier 2.

EuroDreams is a success, especially online, as this game has the highest digitisation rate of draw games.

-

- Low number of high jackpot Euromillions draws (> 75 million euros)

After a 2022 financial year that had registred a record number of high jackpot Euromillions draws (43), 2023 was marked by the low number of these draws (23), particularly in the 2nd semester (8 vs. 27 in 2022), which affected overall stakes given the strong attraction of such jackpots. Nevertheless, stakes on high jackpots offered in 2023 have reached historically very high levels.

As Euromillions is a game with a high stakes-into-revenue conversion rate, the later was therefore particularly affected by the low number of high jackpot draws. The same applies to the performance of the online lottery, as this game has a significant digitisation rate.

Net gaming revenue from online lottery games increased by more than 10%, and by more than 17% excluding Euromillions. This performance was mainly due to a further increase in the number of players. More than 5 million players played at least once a year in an FDJ online lottery game.

In terms of responsible gaming, the target of generating less than 2% of the gross gaming revenue of online lottery games with high-risk players was achieved in 2023.

-

- New Amigo formula

Amigo, a point-of-sale game with a draw every 5 minutes, was relaunched in early June 2023 with a revised formula in accordance with the decision of the French regulator (Autorité nationale des jeux). This revision notably concerns the reduction in the number of draws (with a suspension of 15 minutes per hour between 6:00 and 14:00) and the maximum amount per bet (8 euros vs. 20 euros). Since its relaunch, Amigo’s business has stabilised at a level down by around 25% compared to the same period in 2022.

- Good momentum in sports betting and online gaming open to competition, bolstered by a presence in all gaming segments

FDJ has historically been present in point-of-sale and online sports betting, online poker since the end of 2022 and online horse-race betting since the acquisition of ZEturf at the end of 2023.

Sports betting and online gaming open to competition continued to show good momentum, with a revenue up 10.9% to 518 million euros and up 8.4% excluding ZEturf.

This performance is based on a still buoyant sports betting market, which benefited in particular from the momentum generated by the FIFA World Cup at the end of 2022. For the 3rd consecutive year, ParionsSport En Ligne has gained market shares. Revenue growth is also explained by the first consolidation of ZEturf in the 4th quarter and sporting results favourable to the operator, in particular during the Champions League and Ligue 1. In addition, the poker offer works very well, with nearly 20% of online sports betting players also playing it.

- Strong growth in online games: net gaming revenue (NGR) up 18.8% to nearly 13% of the total, compared to more than 11% in 2022

The strong momentum of the Group’s online activities, lottery on the one hand and sports betting and online gaming open to competition on the other, enabled FDJ to record an increase of 18.8% in its net gaming revenue from online games, which represents nearly 13% of total NGR compared to more than 11% in 2022. Excluding the integration of PLI and ZEturf in the 4th quarter, the annual increase in NGR for online gaming activities would have been 13.9%.

Confirmation of the exclusive rights of La Française des Jeux by the Council of State

Following a referral in December 2019 by an association and several gambling companies, the French Council of State ruled, on 14 April 2023, that La Française des Jeux’s exclusive rights comply with European Union law. It also ruled that the twenty-five-year term of its exclusive rights, defined in the framework of the Pacte Act, is not excessive.

Concerning the equalisation payment of 380 million euros paid to the State in respect of its exclusive rights, the Council of State will decide after the European Commission’s decision on the appropriateness of this sum, following its State aid investigation launched in July 2021.

External growth transactions

- Premier Lotteries Ireland (PLI)

On 3 November 2023, FDJ finalised the acquisition of 100% of the share capital of Premier Lotteries Ireland, which holds exclusive rights to operate the Irish National Lottery until 2034, after the authorisation from the Irish National Lottery regulator. This transaction is part of FDJ’s strategic ambition to become an international B2C operator and FDJ thus operates a foreign lottery for the first time.

PLI’s strategic plan aims to accelerate its growth and increase its profitability by sharing the best practices of the two operators so as to capitalise on FDJ’s experience to run PLI’s instant games portfolio, boost the draw game player base, and continue to improve the digital experience of Irish players.

- ZEturf

The acquisition of the ZEturf group, an online horse-race betting and online sports betting operator under the ZEbet brand, was finalised on 29 September 2023 following the authorisation from the French Competition Authority.

ZEturf rounds out FDJ’s online betting offering, which has become the 4th largest operator in the French sports betting and online gaming open to competition market, with a market share of more than 10%.

In order to take full advantage of the merger with ZEturf and the synergies within its competitive online activity, the FDJ Group will adopt a new organisation for this activity, in line with the commitments made to the Competition Authority.

Societal commitments

- Increased support for the prevention of underage gambling

To further strengthen its actions in favour of responsible gaming, FDJ is providing €10 million over the 2023-2027 period to support the underage gambling prevention programme targeted at young people and implemented by the ARPEJ association[4].

- Extra-financial ratings maintained at the best levels

- For the fifth consecutive year, Moody’s ESG Solutions awarded FDJ the highest sustainability rating in the “Hotels, Leisure and Services” sector with 72/100. The second largest operator in the sector received a rating of 53/100. The Group is ranked 20th out of nearly 5,000 global companies monitored by Moody’s ESG Solutions.

- FDJ remains in the Top 3 in its sector in the S&P Global ESG Scores rating despite increased requirements.

- MSCI raised FDJ’s sustainability rating from “A” in 2021 and 2022 to “AA” in 2023, with a maximum rating of 10/10 on the environmental side.

- Performance that benefits all stakeholders

For the eighth consecutive year, the Economic Information and Forecasting Office (Bureau d’information et de prévision économique or BDO-Bipe) assessed the FDJ Group’s economic and social contribution in France.

- In 2023, FDJ’s contribution to national wealth amounted to 6.6 billion euros, i.e. 0.25% of Gross Domestic Product (GDP)

- In terms of employment, the FDJ Group’s activities created or maintained 56,000 jobs in France, including 21,800 in the network of bars, tobacconists and newsagents.

- FDJ’s growth is benefiting the national community and in particular public finances, with a total contribution of more than 4.3 billion euros, including 4.1 billion euros in public levies on games, which benefit:

- Endangered French heritage sites. Thanks to the Mission Patrimoine lottery games, more than 28 million euros were donated to the French national heritage foundation (Fondation du Patrimoine) for the 2023 edition;

- And French sport, both professional and amateur, via the action of the National Sports Agency (ANS).

The company’s economic impact is significant, particularly on:

- Local retail, with 983 million euros paid to its more than 29,000 retailers;

- French suppliers, with 648 million euros in purchases, mainly from SMEs and mid-caps, i.e. more than 85% of the total of purchases.

FDJ Group’s value creation is shared between employees and shareholders, with:

- Personnel costs of 369 million euros, including profit-sharing and incentive bonuses representing 24% of total payroll[5];

- 262 million euros in dividends in respect of the 2022 financial year, which benefit veterans associations, who are founding shareholders, to finance their social initiatives, and nearly 400,000 individual shareholders.

Post-closing events

On 22 January 2024, FDJ announced that it was launching a tender offer for Kindred, one of Europe’s leading online betting and gaming companies, to implement its ambition to become an international gaming operator, and thus create a European champion.

This offer:

- Is made at a price of SEK 130 per share listed on Nasdaq Stockholm, and corresponds to an enterprise value of Kindred of 2.6 billion euros;

- and will create value for FDJ’s shareholders. In particular, it should result in a more than 10% accretion in dividend per share, as soon as the dividend paid for the 2025 financial year.

- The transaction takes the form of a public tender offer, which will open on 20 February 2024 for a period of nine months. The completion of the takeover bid will remain subject in particular to obtaining regulatory authorisations and the acquisition by FDJ of at least 90% of Kindred’s share capital.

2024 targets

In line with the Group’s medium-term objectives, in 2024 FDJ aims:

- Revenue growth from lottery and sports betting and online gaming open to competition activities in France of around 5%. With the contribution from other activities (International, Payment & Services), the Group’s revenue growth should be around8%;

- and a recurring EBITDA margin of around 24.5%.

To date, these projections do not include any element related to the tender offer on Kindred.

In 2024, the lottery will benefit from the contribution of EuroDreams on a full-year basis but will continue to be affected by Amigo’s new formula in comparison until early June. A normative level of Loto and Euromillions draws with high jackpots was retained.

In sports betting and online gaming open to competition, the 2024 financial year will be marked by numerous major sporting events (Africa Cup of Nations, UEFA EURO 2024, Paris 2024 Olympic and Paralympic Games) and FDJ will continue to capitalise on its offering enrichment. The high margin recorded by the operator on sports betting in 2023 does not seem to be able to be renewed for the 2024 financial year. Finally, the establishment of a new organisation in order to fully benefit from the potential of the merger with ZEturf, in line with the commitments made to the Competition Authority, is continuing.

At the same time, the Group will continue to develop its societal commitments, in particular to the fight against underage gambling and excessive gambling.

2023 activity and results

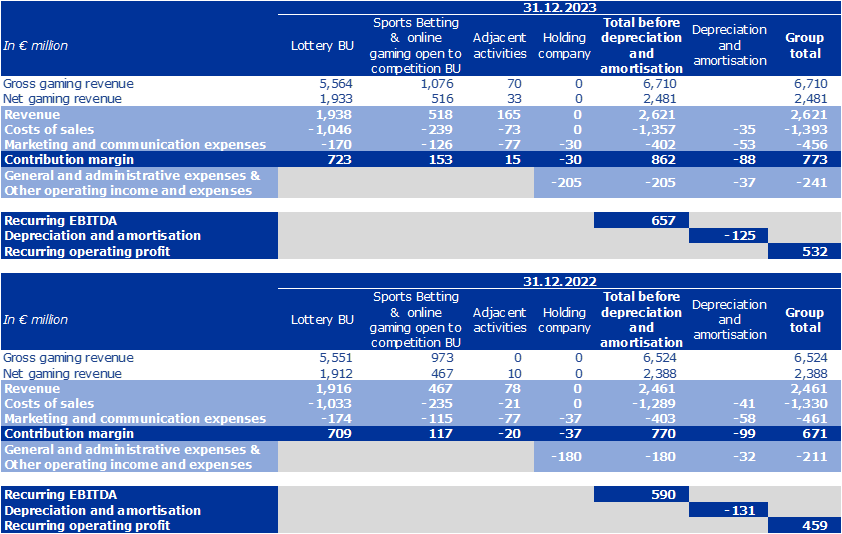

- Revenue of 2,621 million euros, up 6.5% and 2.8% on a like-for-like basis

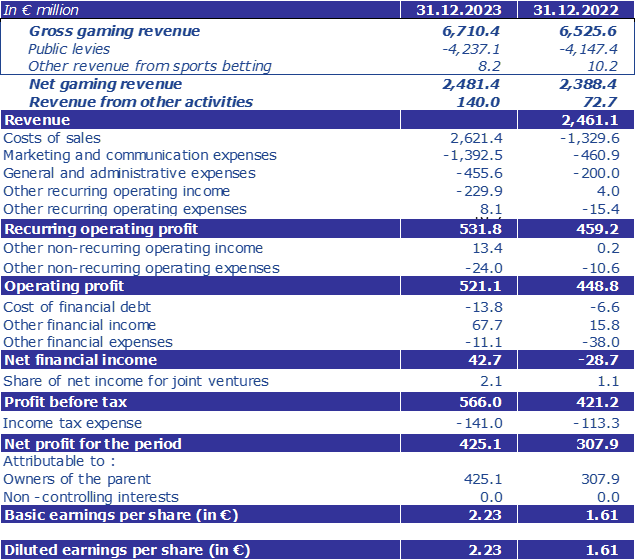

Gross gaming revenue (GGR = stakes – player winnings) came to 6,710.4 million euros (+2.8%). Net gaming revenue (NGR = GGR – public levies on games) constitutes the FDJ Group’s remuneration from gaming. After 4,237.1 million euros in public levies (+2.2%), the NGR amounted to 2,481.4 million euros (+3.9%). After taking into account revenue from other activities for 140.0 million euros, the Group’s revenue amounted to 2,621.4 million euros, up 6.5% and up 2.8% on a like-for-like basis.

| €m | 2023 | 2022 | Change in €m | % change | Scope impact | Organic change |

| Lottery | 1,937.8 | 1,916.2 | +21.5 | +1.1% | – | +1.1% |

| Sports betting and online gaming open to competition | 518.1 | 467.0 | +51.1 | +10.9% | +2.5% | +8.4% |

| Other activities | 165.5 | 77.8 | +87.6 | +112.6% | +104.7% | +7.9% |

| Group total | 2,621.4 | 2,461.1 | +160.3 | +6.5% | +3.7% | +2.8% |

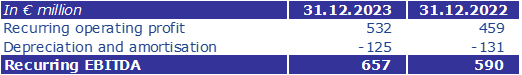

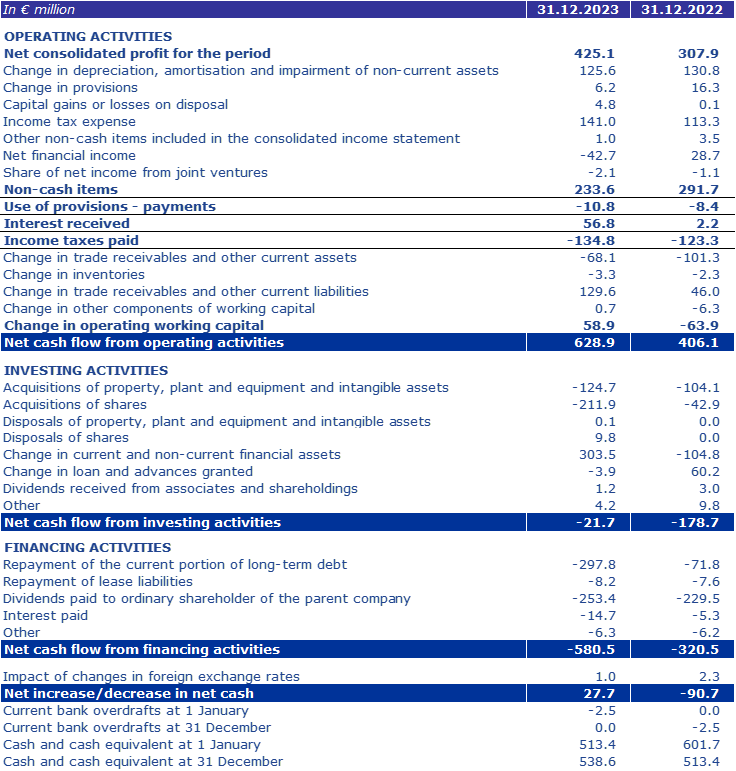

- Recurring operating income of 532 million euros and recurring EBITDA of 657 million euros, representing a recurring EBITDA margin on revenue of 25.1% compared to 24.0% in 2022

Cost of sales amounted to 1,392.5 million euros (+4.7%). This includes 983 million euros (+1.9%) in remuneration paid to retailers, which are correlated to stakes recorded in the network. The increase in other sales costs, 44.6 million euros, is mainly due to acquisitions, particularly that of Aleda.

Marketing and communication costs include the costs of advertising and designing offers, as well as the costs of IT development and operation of games and services. They amounted to 455.6 million euros. The decline of 1.2% was mainly due to advertising spending, particularly corporate communications, which came out at 1% of GGR.

Administrative and general costs mainly comprise the personnel and operating costs of the central functions, as well as the costs of buildings and IT infrastructure. Their 14.2% increase to 241.5 million euros was due in particular to a scope effect as well as the exceptional allocation of 10 million euros to support actions to prevent underage gambling carried out by the associative sector over the 2023-2027 period.

The Group’s recurring operating profit was thus 531.8 million euros, up 15.8%.

Net depreciation and amortisation expenses amounted 125.1 million euros compared to 130.9 million euros in 2022.

Recurring EBITDA, recurring operating profit restated for depreciation and amortisation, was 656.8 million euros, up 11.3%, i.e. a recurring EBITDA margin of 25.1%, up from 24.0% recorded in 2022.

The recurring EBITDA level notably reflects the strong digital momentum. It takes into account the exceptional level of sporting results favourable to the operator at the end of the year and a reversal of provisions relating to disputes with former broker-agents. Without these elements, the margin rate would be 24.3%.

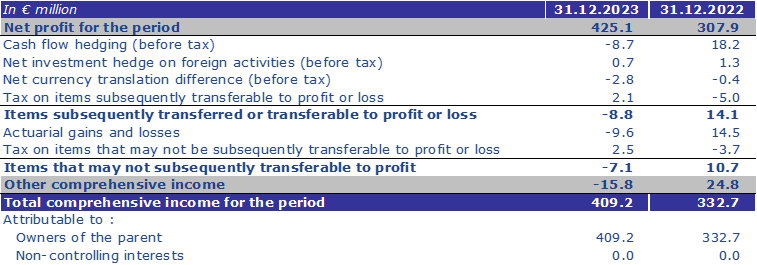

- Net income of 425 million euros compared to 308 million euros in 2022

In 2023, non-recurring operating revenue and expenses were stable at -10.6 million euros, and included in particular costs related to external growth transactions.

Operating income amounted to 521.1 million euros in 2023, up 16.1% compared to 2022.

The change in financial profit (+42.7 million euros in 2023 versus -28.7 million euros in 2022) is mainly explained by the high level of interest rates that remunerate the Group’s cash position, whereas in 2022, the decline in the markets had affected the Group’s financial profit. The revision of the Group’s investment policy at the end of 2022 enabled it to fully benefit from this rate hike in 2023.

The tax expense amounted to 141.0 million euros, representing an effective rate of 25.0%.

Consolidated net profit thus amounted to 425.1 million euros compared to 307.9 million euros in 2022.

By business

The Group’s organisation is structured around three operating segments: two Business Units (BUs), the Lottery and Sports betting and online gaming open to competition, and diversification activities (International, including PLI, and Payment & Services) with cross-functional support functions (in particular customer, distribution and information systems). In addition, the holding company mainly covers overheads.

The contribution margin is one of the key performance indicators for these segments. It is calculated as the difference between segment revenue, sales costs (including retailer remuneration) and marketing and communication costs (excluding depreciation) allocated to them.

- Lottery

Lottery revenue totalled 1,937.8 million euros, up 1.1%.

Sales costs totalled 1,045.5 million euros (+1.2%) and correspond mainly to the remuneration of retailers, which are correlated to stakes recorded in the network.

Marketing and communication costs totalled 169.6 million euros, down 2.7%, mainly due to the decrease in advertising and promotional expenses.

The contribution margin of the lottery was 722.6 million euros, i.e. a contribution margin on revenue of 37.3%, up from 37.0% in 2022.

- Sports betting and online gaming open to competition

Revenue from sports betting and online gaming open to competition amounted to 518.1 million euros, up 10.9% compared to 2022 and up 8.4% excluding the first consolidation of ZEturf in the 4th quarter. Stable at the end of September 2023 compared to 2022, the operator’s margin[6] increased significantly in the 4th quarter compared to the low rate in the 4th quarter of 2022 attributable in large part to the victories of favourites in World Cup matches. Thus, over the full year, the operator’s margin stood at more than 11%, up from its 2022 level.

Cost of sales amounted to 238.8 million euros, an increase of 1.6%. They correspond mainly to the remuneration of retailers, which are correlated to stakes recorded in the network. Other sales costs are increasing, in particular due to the integration of ZEturf and the first year of poker.

Marketing and communication costs amounted to 125.9 million euros (+9.8%). Excluding ZEturf, they rose by only 3.4%, driven by the development of the offering, while advertising and promotional costs decline.

The contribution margin for sports betting was 153.4 million euros, i.e. a contribution margin on revenue of 29.6%, compared to 25.1% in 2022.

- Other activities

Other activities (International including PLI, Payment & Services) recorded a revenue of 165.5 million euros. The 87.6 million euros increase compared to 2022 is mainly attributable to the full-year effect of the acquisitions of L’Addition (end-July 2022) and Aleda (end-November 2022) and the contribution of PLI from November 2023.

The contribution margin of 15.3 million euros in 2023 is mainly attributable to PLI. Furthermore, as announced, measures have been taken to improve the profitability of the Group’s activities in the United Kingdom, which is at breakeven in terms of contribution margin.

- Holding company

Holding costs amounted to 234.5 million euros. Their 18.1 million euros increase compared to 2022 is mainly attributable to the allocation to actions to prevent underage gambling and perimeter effects.

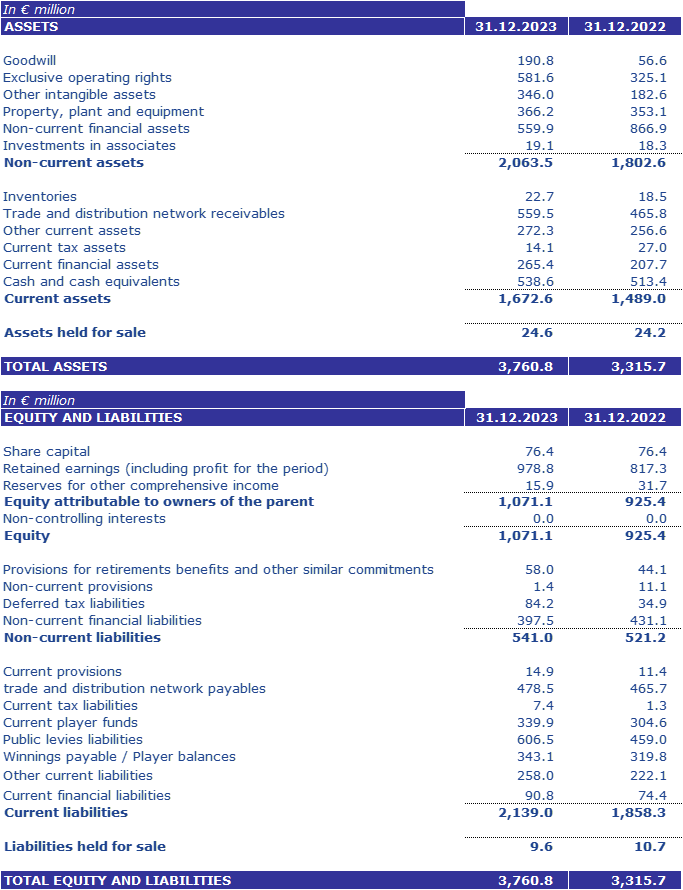

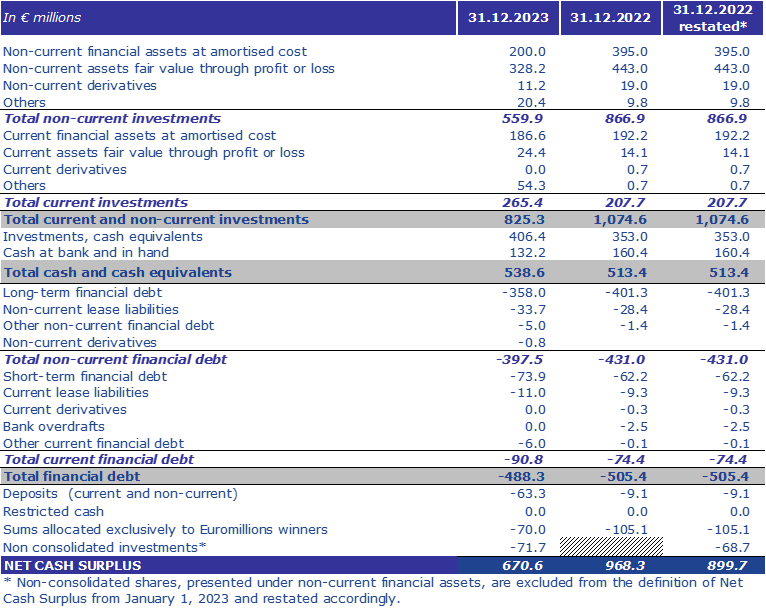

Solid financial structure and free cash flow of 855 million euros

The Group’s investments in tangible and intangible assets amounted to 124.7 million euros, compared to 104.1 million euros in 2022. They mainly relate to the development of information and back-office systems as well as point-of-sale gaming terminals.

Acquisitions of ZEturf and PLI represented 483 million euros, taking into account the net debt of the acquired companies.

The normalised change in working capital linked to the activity (restated for calendar impacts and unclaimed winnings) was 54 million euros in excess. Thus, based on recurring EBITDA of 657 million euros, free cash flow[7] amounted to 586 million euros, up from 545 million euros in 2022, with a recurring EBITDA to cash conversion rate of 89%.

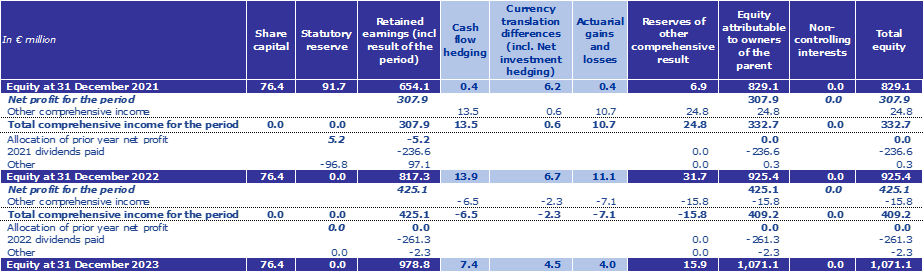

At the end of December 2023:

- The Group’s shareholders’ equity stood at 1,071.1 million euros out of a balance sheet total of 3,760.8 million euros;

- The net cash surplus[8], one of the indicators representative of the Group’s net cash position, was 671 million euros, down from 900 million euros restated[9] at the end of 2022; FDJ has available cash[10] of 855 million euros.

Dividend

FDJ’s Board of Directors, at its meeting of Tuesday 14 February, approved the Group’s 2023 financial statements. It will propose a dividend of 1.78 euros per share to the Shareholders’ Meeting of 25 April 2024, an increase of 30%, i.e. a payout ratio of 80% in line with the Group’s commitments. Payment will be made on 7 May 2024.

The audit procedures on the consolidated financial statements have been completed. The audit report will be released after the review of the management report is finalized.

A financial presentation and the 2023 consolidated financial statements, in French and English, are available on the FDJ Group website:

https://www.groupefdj.com/en/publications-and-results/

Next financial release

The FDJ Group will publish its revenue for the 1st quarter 2024 on Wednesday 17 April after the market close.

The FDJ Group will hold its Shareholders’ Meeting on Thursday 25 April 2024.

Forward-looking statements

This press release contains information on FDJ Group’s objectives, as well as forward-looking statements. These statements do not reflect historical data and must not be interpreted as guarantees that the facts and data mentioned will occur. The information contained herein is based on what the Group considers to be reasonable data, assumptions and estimates. FDJ operates in a competitive and rapidly changing environment. The Group is therefore not in a position to anticipate all of the risks, uncertainties or other factors likely to impact its activity, the potential impact thereof on its activity, or even to what extent the materialisation of a risk or a combination of risks could present significantly different results from those mentioned in any forward-looking statements. The information contained herein is provided solely as at the date of the present press release. The Group makes no commitment to update this information or the assumptions on which it is based, aside from any legal and regulatory obligations to which it is subject. FDJ will disclose to the market any update to information provided that is likely to have a significant impact on its activities, results, financial position or outlook, in accordance with applicable regulations, and will comply with the ongoing disclosure obligations applicable to all companies the shares of which are listed for trading on the regulated market of Euronext Paris.

[1] Including Aleda and L’Addition on a full-year basis in 2022 and excluding the 2023 contribution from PLI and ZEturf

[2] NGR corresponds to gross gaming revenue (GGR = stakes – player winnings) net of public levies

[3] Proposed to the Shareholders’ Meeting of 25 April 2024

[4] Support is given to the RPEJ endowment fund

[5] Withheld at the Urssaf gross level

[6] NGR rate on stakes

[7] Free cash flow = cash flow generated by operations after investments related to operations.

[8] It corresponds to non-current financial assets, current financial assets and cash and cash equivalents, net of non-current financial liabilities and current financial liabilities, less: (i) current and non-current deposits and guarantees given; (ii) cash subject to restrictions; (iii) sums allocated exclusively to the winners of the Euromillions game; (iv) non-consolidated securities, mainly composed of units in venture capital funds (FDJ Ventures).

[9] Non-consolidated shares, presented under non-current financial assets, are excluded from the definition of Net Cash Surplus from January 1, 2023 and restated accordingly.

[10] Cash available = cash & cash equivalents net of Euromillions funds, and deposits available within thirty-two days.